The next installment of the Federal Reserve meeting, with the press release that is published at close the meeting of the Monetary Policy Committee. This is followed by a press conference hosted by the president of the Fed, Janet Yellen. All eyes are on comments surrounding interest rates, and how the Fed see’s the economy is fairing.

Today on the foreign exchange market, the Euro was trading within narrow ranges despite the huge adjustment in policy by the Bank of Japan (BoJ). Although it is normal for the Euro to trade static in light of a upcoming Fed meeting.

The euro has remained steady against the dollar at 1.1149 and versus the Yen at 113.03

During the night, the Bank of Japan (BoJ), the Monetary Policy Committee announced new measures. The BoJ has decided to adopt a target on its long-term interest rates. This change in its monetary policy strategy is a surprise, three years after the launch of a bold policy of the Governor Haruhiko Kuroda, who gave way to skepticism about its effectiveness.

According to analysts the objective is to try and counter the negative effects of redemption of bond assets in bulk, pulling the short interest rate and longer term under 0.

In the USA, Fed funds futures anticipate a rate hike this evening with a probability of 15%. From the many economists surveyed by Bloomberg, only 4 anticipate a rise in Fed Funds tonight, barely 4% of consensus. Which is usually a sign that there will be no change, however there is always room for a shock.

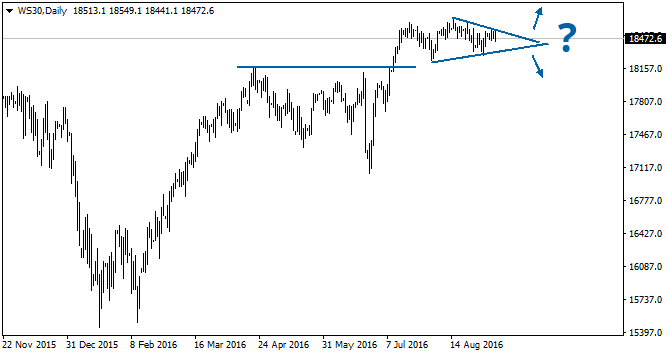

As always expect volatile moves after the Fed release their data. Stocks, Gold and Foreign Exchange markets are poised to make a move, guessing can spell disaster. Whilst these data sets can change a trend, more often than not they do not change the longer term direction, once the initial volatility has subsided.

from http://www.livecharts.co.uk/livewire/2016/09/fed-meeting-set-to-show-the-way/