Wednesday 31 May 2017

Dalradian Resources' shares rise after positive Curraghinalt update

from LiveCharts News - http://www.livecharts.co.uk/share_prices/news_article.php?id=26003503

Landore widens loss, eyes more equity raises to carry out development plans

from LiveCharts News - http://www.livecharts.co.uk/share_prices/news_article.php?id=26002514

Lamprell surges on news of Saudi Aramco JV

from LiveCharts News - http://www.livecharts.co.uk/share_prices/news_article.php?id=26002110

Tuesday 30 May 2017

Vast Resources' shares rise on approval for $4m disposal

from LiveCharts News - http://www.livecharts.co.uk/share_prices/news_article.php?id=25998433

Science in Sport confirms patent for WHEY20

from LiveCharts News - http://www.livecharts.co.uk/share_prices/news_article.php?id=25998227

Kainos Group's shares slip after FY profit dips

from LiveCharts News - http://www.livecharts.co.uk/share_prices/news_article.php?id=25997775

Tuesday 23 May 2017

Opec Trying To Put Some Support Into Oil Prices

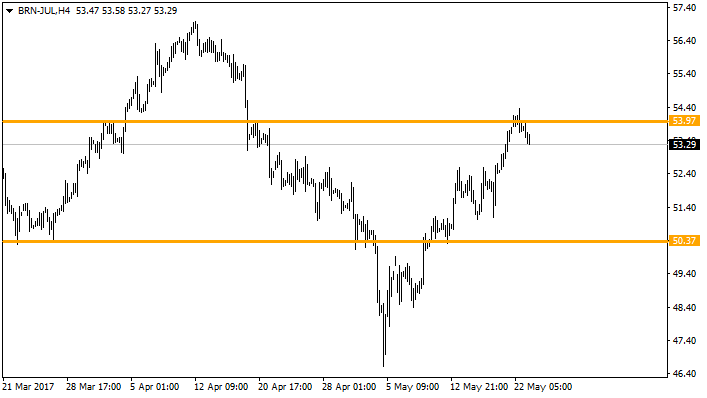

This week began in much the same fashion as they left last week with Oil prices rising. Expectation of a cut in output from OPEC, which could extend into 2018, pushed Crude Oil higher on the futures exchanges. In early trade UK on Tuesday, Brent Oil had fallen back from it’s high, but still remains over $5 higher than the early May low.

Oil prices have also been aided by a falling US Dollar, which has been on a steady downward trajectory for the last 10 days.

Market commentators are wary of the output cut talk, with many waiting to see the outcome of the Opec meeting on Thursday. Analysts state that they are not too sure how far OPEC can actually cut, whilst global demand is somewhat subdued, and US shale production on the rise. But we shouldn’t underestimate the need for OPEC, and particularly Saudi Arabia to keep Oil prices up and around the $50 per barrel mark.

In the short term there are now some clear points on the charts for some support and resistance. Below us, just above the $50 round number, and above us at the high of Monday.

It seems that each time Oil prices manage to gather some downward momentum, to under $50, that OPEC springs into action. This is set to continue (no doubt) into 2018, and many analysts comments are suggesting that prices are set to rise into 2020 and beyond as supply will not match the pace of demand, even in the face of greener energy sources.

There has been a lack of investment into Oil industries over the last two or three years. Obviously there will need to be a period of catching up. Demand will still be high, but supply may not reach the expected amounts for a while. This has fuelled comments from leading sources stating higher prices for Oil, and many other commodities into the early part of the next decade.

from http://www.livecharts.co.uk/livewire/2017/05/opec-trying-to-put-some-support-into-oil-prices/

Monday 8 May 2017

Gold Prices and Why There’s Nobody Buying

At the back end of last week Gold prices slid to levels not seen since mid March, all-in-all it was Gold’s worst performing week of 2017 so far. The recent strength of the US Dollar put pressure on Gold as expectations of a rate rise grow.

The US Fed gave indication that planned rate rises this year were still on track, with many commentators looking to June as the likely month they will increase. The strong non-farm payroll data on Friday reinforced this thinking.

Gold can suffer while the Dollar strengthens because commodities priced in US Dollars become more expensive, and demand from those trading in other currencies often falls.

Goldman Sachs remain cautious on Gold prices in the near term, stating: “In the very near term we continue to expect that gold will trade moderately lower – our three-month target is $1,200/oz, as a number of bearish catalysts have yet to fully play out,”.

With stocks still rising and consolidating near all-time highs, there seems to be no rush to Gold either from worried investors. However, it would be worth keeping an eye on Gold, for any sudden movements from a support level, as stocks may pull back slightly as the summer months commence.

What is worth noting is that Gold currently trades above a reasonably strong level of support around $1200. On the chart below you can see the touches of lows and attraction to that price level.

This really should be the line in the sand that investors will be watching. A hold above could see the next move in Gold head higher, consequently a clean break of this level (maybe on a rate rise) could signal further weakness and tests of levels from late 2016.

Either way there is something brewing. A critical time for Gold approaches.

from http://www.livecharts.co.uk/livewire/2017/05/gold-prices-and-why-theres-nobody-buying/